We’ve created this guide and the FAQs below to help you understand the health insurance options available to you and your family in Montana. An ACA Marketplace (exchange) plan – or Obamacare – is a good option for people who need to buy their own individual or family health coverage. This includes people who aren’t eligible for Medicaid, Medicare, or an affordable plan offered by an employer.

Montana uses the federally run Marketplace, which is HealthCare.gov . Three private insurance companies offer coverage in the Montana Health Insurance Marketplace. 1 And unlike many states where coverage areas vary from one carrier to another, all three insurers offer Marketplace coverage statewide in Montana. 2

Income-based subsidies are available through the Montana Marketplace: Most enrollees qualify for premium subsidies, and many also qualify for subsidies that reduce out-of-pocket medical costs. 3

If the Marketplace determines that you or your kids are likely eligible for Medicaid or CHIP (Healthy Montana Kids), they will refer you to Montana Medicaid/CHIP .

Hoping to improve your smile? Dental insurance may be a smart addition to your health coverage. Our guide explores dental coverage options in Montana.

Learn about Montana's Medicaid expansion, the state’s Medicaid enrollment and Medicaid eligibility.

Use our guide to learn about Medicare, Medicare Advantage, and Medigap coverage available in Montana as well as the state’s Medicare supplement (Medigap) regulations.

Short-term health plans provide temporary health insurance for consumers who may find themselves without comprehensive coverage. Learn more about short-term plan availability in Montana.

To enroll in private health coverage through Montana’s Marketplace (HealthCare.gov), you must: 4

So most people are eligible to enroll in Marketplace coverage. But qualifying for financial assistance (premium subsidies and cost-sharing reductions) is a bit more complex. Eligibility for financial assistance depends on your income, and you must also:

You can sign up for an ACA-compliant individual or family health plan in Montana during the annual open enrollment period , which runs from November 1 through January 15.

For coverage to take effect on January 1, you must complete your enrollment by December 15. If your application is submitted between December 16 and January 15, your coverage will take effect on February 1. 4

Once the open enrollment window ends, you may still be eligible to enroll or make a plan change if you experience a qualifying life event , such as giving birth or losing other health coverage. Some people can enroll year-round even without a specific qualifying event.

Enrollment in Montana Medicaid and Healthy Montana Kids (CHIP) is available year-round. 7 If you’re eligible for either program, you can enroll anytime.

To enroll in an ACA Marketplace (exchange) plan in Montana, you can:

You can also call HealthCare.gov’s contact center by dialing 1-800-318-2596 (TTY: 1-855-889-4325). The call center is available 24 hours a day, seven days a week, except for holidays.

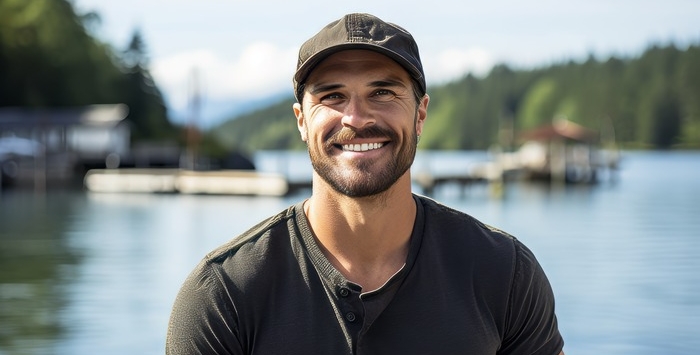

You may find affordable health insurance coverage in Montana by enrolling through HealthCare.gov. This is especially true if you qualify for subsidies, and most enrollees in Montana are subsidy-eligible.

The Affordable Care Act created income-based premium subsidies called Advance Premium Tax Credits (APTC). 9 If you’re eligible for APTC, it will reduce the amount you owe in premiums each month – sometimes even to $0 , depending on your income and the plan you select.

Eighty-nine percent of Montana’s Marketplace enrollees were receiving premium subsidies as of early 2024. These subsidies paid an average of $505/month, reducing the average enrollee’s premium to about $156/month (including those who paid full price). 10

In addition to premium subsidies, you may also qualify for cost-sharing reductions (CSR) if your household income isn’t more than 250% of the federal poverty level . CSR subsidies will make the deductible and other out-of-pocket expenses (for a Silver-level plan) smaller than they would otherwise be. Thirty percent of Montana’s Marketplace enrollees were receiving CSR benefits in 2024. 10

You can combine APTC and CSR benefits if you’re eligible for both, as long as you select a Silver-level plan (APTC can be used with plans at any metal level, but CSR benefits are only available on Silver plans).

Montana implemented a reinsurance program in 2020, which resulted in overall average rate decreases that year and relatively flat rates the following year. 12 So if you’re not eligible for premium subsidies in Montana, the reinsurance program does ensure that your premiums are lower than they would otherwise be.

Depending on your income and circumstances, you may find that you’re eligible for free or low-cost health coverage through Montana Medicaid or Healthy Montana Kids (CHIP). Check to see if you meet the criteria for these programs in Montana.

Three private insurance companies offer Marketplace health insurance coverage in Montana, 13 and all three have statewide coverage areas. 2

All three insurers have filed rates and plans for 2025. 14

One of Montana’s insurers, Montana/Mountain Health CO-OP, is among just three ACA-created CO-OPs still in operation nationwide.

Montana’s individual/family health insurers have filed the following average rate changes for 2025, 15 (Rates are under review by state regulators and will be finalized before open enrollment begins in November 2024.)

Source: Federal rate review database 16

Average rate increases are for full-price plans. But 89% of Marketplace enrollees in Montana receive premium tax credits that cover some or all of their monthly premium costs. 10

These subsidies are adjusted each year to match changes in the benchmark plan (the second-lowest-cost Silver plan) in each area. As a result of the American Rescue Plan and the Inflation Reduction Act, subsidies are larger and more widely available than they were in the past, and that will continue to be true at least through 2025. 17

For perspective, here’s an overview of how average full-price premiums have changed in Montana’s individual/family health insurance market over the years:

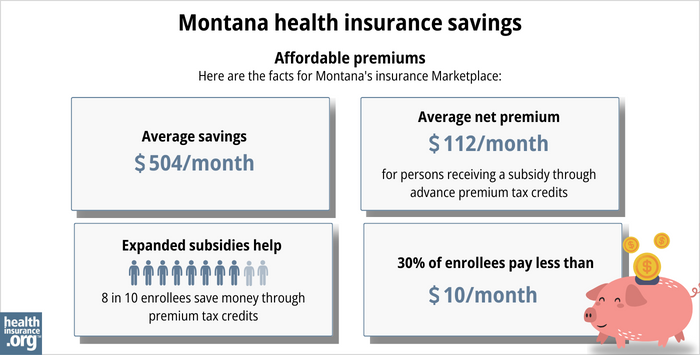

A record-high 66,336 people enrolled in private plans through the Marketplace in Montana during the open enrollment period for 2024 coverage. 28

Source: 2014, 29 2015, 30 2016, 31 2017, 32 2018, 33 2019, 34 2020, 35 2021, 36 2022, 37 2023, 38 2024 39

HealthCare.gov

The Marketplace in Montana, where residents can enroll in individual/family health coverage and receive income-based subsidies. You can reach HealthCare.gov at 800-318-2596.

Montana Commissioner of Securities and Insurance

Licenses and regulates health insurance companies, agents, and brokers; can provide assistance to consumers who have questions or complaints about entities the Commissioner regulates.

Montana State Health Insurance Assistance Program

A local service that provides assistance and enrollment counseling for Medicare beneficiaries and their caregivers.

Montana Medicaid and Healthy Montana Kids

(Montana’s Children’s Health Insurance Program)

Louise Norris is an individual health insurance broker who has been writing about health insurance and health reform since 2006. She has written dozens of opinions and educational pieces about the Affordable Care Act for healthinsurance.org.